2025 Benefits at a Glance

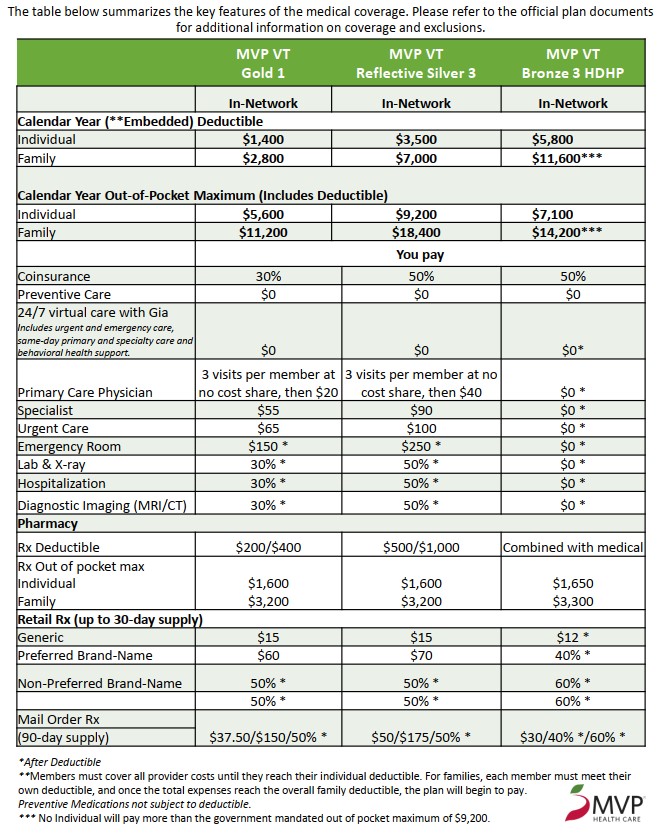

Your Medical Benefits

Medical Contributions

2025 Semi-Monthly Medical Rates

Helpful Resources

Prescription Benefits

MVP Members have access to great prescription drug benefits.

Click to access your Prescription Benefits through MVP.

Forms

Telemedicine

with Gia mobile app by MVP

877-GoAskGia (877-462-7544)

https://www.mvphealthcare.com/welcome/gia-by-mvp

Telemedicine technology gives you access to the providers you know and trust, all from the convenience of your home – or anywhere! The Gia by MVP mobile app is a guide to your health and your health plan, with 24/7 access to virtual care and important plan information. Gia by MVP’s virtual care services by MVP provides fast access to your plan info, including your MVP ID card, new and past claims, progress towards deductibles and more. All for $0, after deductible.

In-person visits and referrals are subject to cost-share per plan. Members enrolled in a Medicare Rx plan without additional MVP medical coverage do not have access to MVP virtual care services through Gia. If you have a life-threatening medical emergency, call 911 immediately.

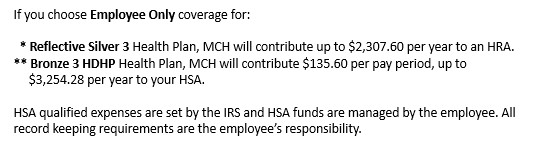

Your Health Reimbursement Account (HRA)

What is an HRA?

Health Reimbursement Arrangements (HRAs) are employer-funded group health plans from which employees are reimbursed tax-free for qualified medical expenses up to a fixed dollar amount per year. The employer funds and owns the arrangement. Funds can only be used for eligible Medical, Dental, and Vision services.

If you choose to enroll in Employee Only coverage on the MVP VT Reflective Silver 3 Health Plan, Mountain Community Health will fund an HRA account of up to $2,307.60 per year through MVP Health Care, beginning on January 1, 2025 to offset your deductible. Contributions for newly-eligible employees will be prorated.

Who pays the provider?

MVP Health Care. At the time of service, any eligible expenses will be paid by your HRA, up to your HRA Account balance. Once your HRA Balance has been exhausted, you must pay all copays and/or charges out of pocket until you reach your deductible of $4,000.

Can I use my HRA to pay for prescriptions?

Yes! You will receive a Debit card to use for prescriptions. If you need a prescription, you will simply use your HRA Debit card at the point of sale.

Reminder:

For The HRA:

- You must choose Employee Only coverage for the MVP VT Reflective Silver 3 Health Plan

- MCH will contribute a maximum of $2,307.60 per year to an HRA.

- Contributions for newly-eligible employees will be prorated.

Eligibility:

Employees must be enrolled in the Employee Only coverage tier on the Silver Reflective 3 Health Plan.

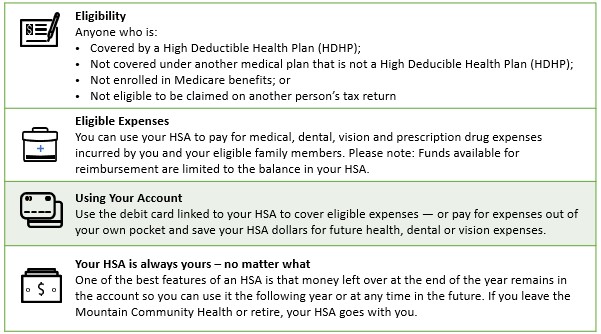

Your Health Savings Account (HSA)

Health Savings Account (HSA)

A Health Savings Account (HSA) is a personal savings account that you own and can use to pay for qualified out-of-pocket medical expenses. Your contributions to the HSA are taken out of your paycheck and are tax-free. Once you enroll in the HSA, you’ll receive a debit card to pay for qualified out-of-pocket medical expenses. Your HSA can be used to pay for your health care expenses and those of your spouse and dependents, even if they are not covered by the High Deductible Health Plan (HDHP).

How a Health Savings Account (HSA) Works

If you enroll in the 2025 Bronze High Deductible Health Plan

The Triple Tax Advantage

HSAs offer three significant tax advantages:

- You can use your HSA funds to cover qualified medical expenses, including dental and vision expenses – tax-free.

- Unused funds grow and can earn interest over time – tax free.

- You can save your HSA dollars to use for your health care when you leave Mountain Community Health or retire – tax-free.

If you want to pay less per paycheck for health care coverage and save tax-free money for future medical expenses, consider enrolling in one of the HDHP plans offered and an HSA.

How a High Deductible Health Plan (HDHP) and a Health Savings Account (HSA) Work Together

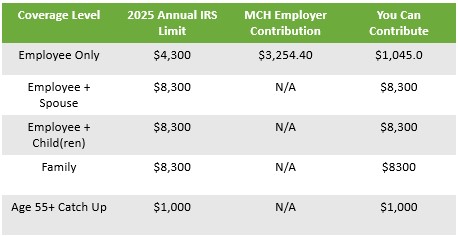

HSA Employer Contribution – Salaried Employees

- You must choose Employee Only coverage for the Bronze 3 HDHP Health Plan

- MCH will contribute $135.60 per pay period to an HSA , up to $3,254.28.

- Employees are responsible for establishing a Health Savings Account (HSA) at the bank of their choice.

Flexible Spending Accounts

Flexible Spending Account (FSA)

An FSA provides you with an important tax advantage that can help pay healthcare and dependent care expenses on a pre-tax basis. By anticipating health care & dependent care costs for the next year & setting aside money, employees can lower their taxable income.

Annual Maximum & Utilization: The annual maximum amount you may contribute to this FSA in 2025 is $3,300. This program allows employees to use pre-tax dollars for certain IRS-approved expenses. By anticipating your family’s healthcare and dependent care costs for the next year and setting aside money, you can lower your taxable income. Any unused FSA dollars up to $660 may be rolled over into the following plan year to use for eligible expenses only.

Some examples include:

- Hearing services, including hearing aids and batteries

- Vision services, including contact lenses, contact lens

solution and eyeglasses - Dental services and orthodontia

- Medical and Rx deductibles; Co-pays & Co-insurance

Limited Purpose FSA

Employees who enroll in the MVP VT Bronze HPHD HSA Health Plan and also elect to contribute to a Health Savings Account (HSA) may still elect a medical FSA but will only be able to use funds for dental & vision expenses. This type of FSA is called a Limited Purpose FSA. Any unused FSA dollars up to $660 may be rolled over into the following plan year to use for eligible expenses.

Dependent Care Account (DCA)

The dependent care flex account allows you to reimburse yourself with pre-tax dollars for daycare

expenses for your children under age 13 and other qualified dependents. You can contribute up

to $5,000 per year; $2,500 if you and your spouse file your taxes separately.

Eligible Day Care Expenses:

- Childcare/Adult Care by a licensed childcare facility for children under age 13 who qualify as dependents on your federal income tax return.

- Childcare/Adult Care for children or adult of any age who are physically or mentally unable to care for themselves and who qualify as dependents.

Ineligible Day Care Expenses

- Child support payments & overnight camp.

- Food, clothing, entertainment, educational supplies and activity fees.

- Cleaning and cooking services not provided by the day care provider.

MVP Health Care: Flexible Spending Accounts

Customer Service: 800-825-5687

Website: www.mvphealthcare.com

Eligibility:

Employees working at least 30 hours per week are eligible for medical insurance coverage on the 1st of the month, following 30 days of employment.

Forms & Additional Information

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below:

To access the FSA Store please visit:

To access the HSA Store please visit:

Additional Information

Your Dental Benefits

Eligibility:

Employees working at least 30 hours per week are eligible for dental insurance coverage on the 1st of the month following 30 days of employment.

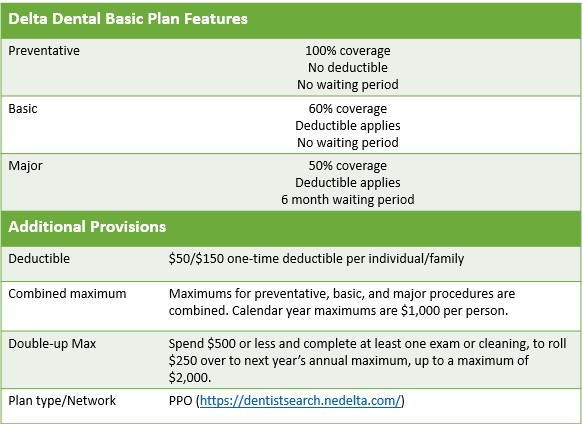

2025 Dental Plan Details

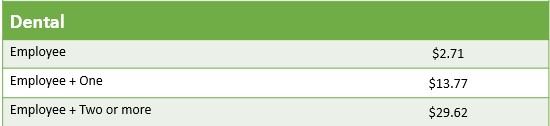

2025 Semi-Monthly Dental Rates

Forms and Plan Documents

Your Vision Benefits

Eligibility

Employees working at least 30 hours per week are eligible for vision insurance coverage on the 1st of the month, following 30 days of employment.

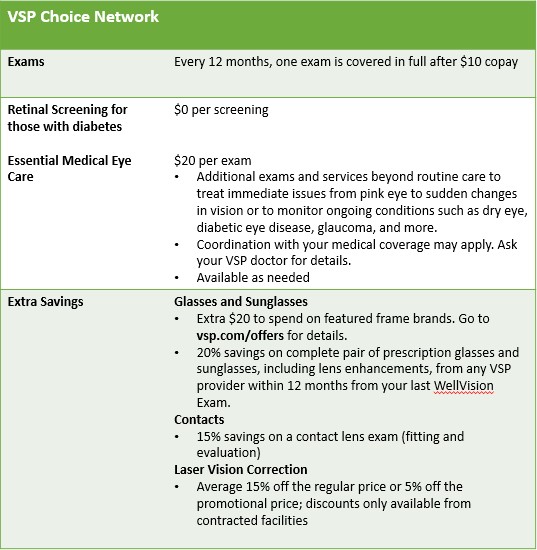

2025 Vision Insurance Details

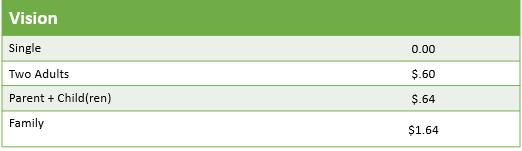

2025 Semi-Monthly Rates

Life Insurance Benefits

Eligibility:

Employees who work 30 or more hours per week will be automatically enrolled in the Employer-Paid Group (Basic) Life and AD&D, as well as have the opportunity to elect additional, Voluntary Life and AD&D coverage. This is an employer paid benefit.

Basic Life and AD&D

Life insurance offers you and your family important financial protection. Mountain Community Health provides employees with a Life and AD&D benefit of $50,000, at no cost. The benefits reduce by 35% upon reaching age 65 and an additional 15% upon reaching age 70. Employees may update their beneficiary information on bswift at any time.

Voluntary Employee & Dependent Life Insurance

Eligibility:

Employees who work 30 or more hours per week have the opportunity to elect additional, Voluntary Life and AD&D coverage. This is an employee paid benefit.

Voluntary Life and AD&D

Life insurance offers you and your family important financial protection. Mountain Community Health provides employees with an opportunity to purchase Individual Term Life and AD&D Insurance for themselves and their family members. You can elect up to $300,000 for yourself, $100,000 for your spouse, or $10,000 for your child(ren). The benefits reduce by 35% upon reaching age 65 and an additional 15% upon reaching age 70. Employees may update their beneficiary information on bswift at any time.

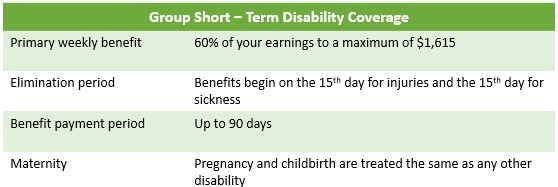

Your Short Term Disability Benefits

Eligibility

Full Time employees who are scheduled to work a minimum of 30 hours per week are eligible for Short Term Disability insurance on the 1st of the month following 30 days of employment. This is an employer paid benefit.

Help protect one of your most valuable assets – the ability to earn an income. If you’re temporarily disabled and can’t work for a short amount of time, you can rely on short-term disability insurance to replace a portion of your weekly income.

Your primary weekly benefit is 60% of your pre-disability earnings to a maximum of $1,615, minus other income sources. Other income sources could include but aren’t limited to Social Security, other earnings, worker’s compensation, state disability (if applicable), and salary continuance. Your benefits are determined by your base wage.

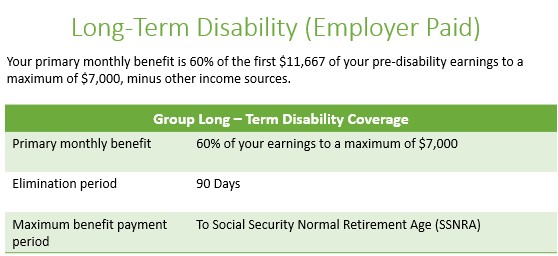

Your Long Term Disability Benefits

Eligibility

Full Time employees who are scheduled to work a minimum of 30 hours per week are eligible for Long Term Disability insurance on the 1st of the month, following 30 days of employment. This is an employer paid benefit.

Your primary monthly benefit is 60% of the first $11,667 of your pre-disability earnings to a maximum of $7,000, minus other income sources.

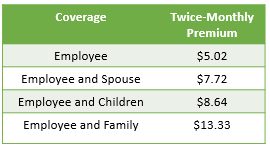

Voluntary Accident Insurance

Eligibility:

Full Time employees who are scheduled to work a minimum of 30 hours per week are eligible for Accident Insurance on the 1st of the month, following 30 days of employment. This is an employee paid benefit.

When you, your spouse, or child has a covered accident, like a fall from a bicycle that requires medical attention, you can receive cash benefits to help cover the unexpected costs. You can use accident benefits to help cover related expenses like lost income, childcare, deductibles, and co-pays. Accident benefits can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are paid directly to you.

You can elect to cover yourself, your spouse, and your children up to age 26.

Voluntary Accident Rates

Voluntary Critical Illness

Eligibility:

Full Time employees who are scheduled to work a minimum of 30 hours per week are eligible for Accident Insurance on the 1st of the month, following 30 days of employment. This is an employee paid benefit.

When you, your spouse, or child is diagnosed with a covered condition, like a heart attack, cancer, stroke, or kidney failure, you can receive a cash benefit to help cover the unexpected costs not covered by your health plan. Critical Insurance benefits can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are paid directly to you. What’s more, all family members on your plan are eligible for a wellness-screening benefit, also paid directly to you once each year per covered person.

You can elect up to $50,000 for yourself, $25,000 your spouse. Dependent child(ren) are automatically covered at 25% of the Employee coverage amount.

Covered illnesses include:

- Alzheimer’s Disease

- Cancer

- Heart Attack

- Stroke

- Parkinson’s Disease

- Multiple Sclerosis

- And more!

Pin Paws Pet Insurance

Mountain Community Health is offering pet insurance to full-time and part-time employees. Your employer’s Pet Insurance Plan through Pin Paws & Met Life will give your pets the best care possible!

Eligibility

All Mountain Community Health employees are eligible. Coverage begins the day following enrollment.

What makes Pin Paws Pet Care different from other pet insurance companies?

• Coverage for cats and dogs of all ages and breeds

• No initial exam/past vet notes required

• Accident coverage starts at midnight

• Customizable deductible and out-of-pocket max

• Annual max payouts as opposed to per incident

• Choose your reimbursement percentage

• Multiple value-added benefits included

• Routine care options available with customized plans

• Available in all 50 states

How do I enroll?

Enrollment is available at any time (not limited to Open Enrollment window or

new hire eligibility).

To enroll, visit: PinPaws.com/mchvt and follow the steps for enrollment.

Depending on your dog or cat, and which plan you choose, your monthly premium will vary. You will need to pay with a personal credit card to sign up.

Contributions

Monthly premiums will vary depending on the age and breed of your dog or cat, as well as which plan or customizations you choose. Employees will be responsible for paying premiums by credit card through Pin Paws.

Your Employee Assistance Program

EAP with Principal – A helping hand when you need it.

An Employee Assistance Program (EAP) is offered to all employees and immediate family members through Principal. Your EAP services are available 24 hours a day, 7 days a week, 365 days a year.

EAP services can help with:

- In-person or virtual counseling

- One valuable way to work through personal or work issues is by talking with a professional. You and your family can meet with a licensed, EAP professional in person, via text message or by live chat, video or phone sessions. Three counseling sessions per year are included.

- Legal, financial and identity theft services

- Legal services: Receive a free 60-minute consultation to help deal with issues such as car accidents or family law.

- Financial wellness: Receive three free 30-minute consultations. This may include help with budget planning, debt consolidation, or retirement planning.

- Identity Theft resources: Receive a free 60-minute consultation to help restore your identity if stolen.

- Work-life web services

- You and your family can access webinars, live talks, and articles on topics such as child and elder care, education, parenting and more.

You can contact the Employee Assistance Program (EAP) via phone at (800) 450-1327 or online at https://member.magellanhealthcare.com/

When you create an account, enter Principal Core as the program name.

Carrier Service Contact

Principal – Employee Assistance Program (EAP)

Phone: (800) 450-1327

https://member.magellanhealthcare.com/

When you create an account, enter Principal Core as the program name.

Forms & Plan Documents:

Your Retirement Benefits

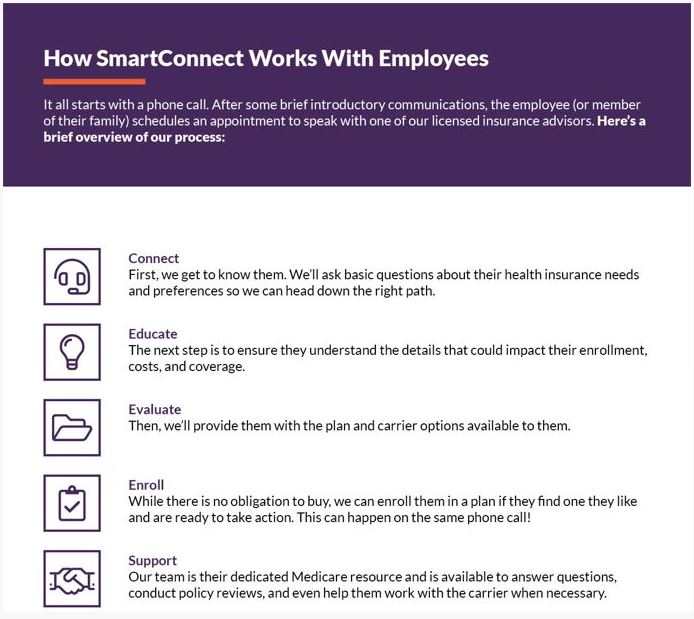

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect

For more information or to get started, please click on the following link:

Weren’t able to attend the webinar? No worries. Please click on the button below to view the video recording of the presentation.

Your Tuition Refinancing Assistance

EXCITING NEW BENEFIT FOR EMPLOYEES!

GradFin is designed to help Mountain Community Health’s employees pay back student loan debt and improve their financial well-being.

Utilizing Mountain Community Health’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

1. Minimum age requirement: In order to participate in the plan, you must be at age 21.

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN